Planned Giving

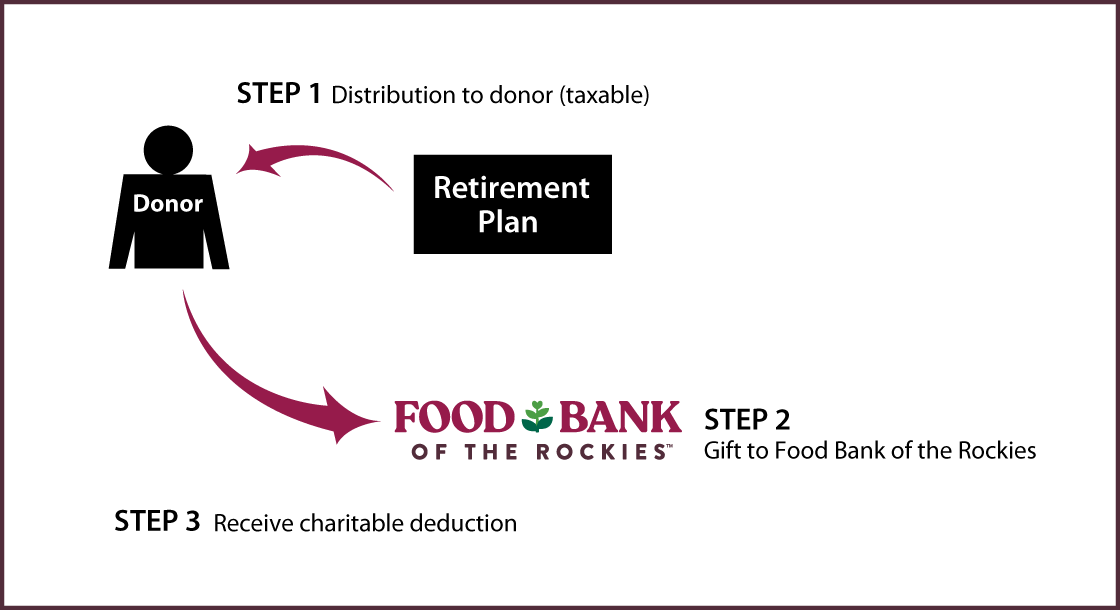

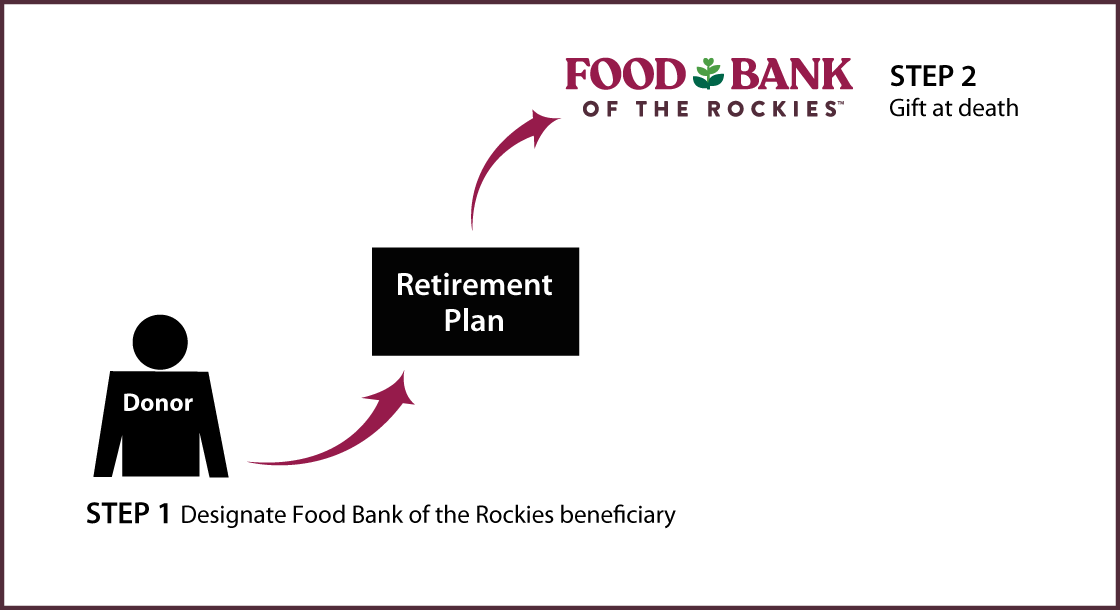

Your retirement-plan benefits are very likely a significant portion of your net worth. And because of special tax considerations, they could make an excellent choice for funding a charitable gift.

Retirement-plan benefits include assets held in individual retirement accounts (IRAs), 401(k) plans, profit-sharing plans, Keogh plans, and 403(b) plans.

Lifetime Gifts  Click to See Diagram |

Estate Gifts  Click to See Diagram |

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer

Wherever hunger rises, so can we.

Food Bank of the Rockies is a 501(c)(3) non-profit organization recognized by the IRS, ID 84-0772672. All donations are tax-deductible.

This institution is an equal opportunity provider. Click here for full USDA non-discrimination statement.

Position

Email:

[email address]

Phone:

[phone number]

Bio